Insiders Guide to Furniture

Furniture Buyer’s Guide

Free In-depth answers to All your furniture questions.

Do You Have Questions About Furniture?

The Insiders Guide to Furniture provides detailed explanations for questions that other blogs, reviews, & articles cannot answer.

What Makes This Blog Different from Other Furniture Review Sites?

Furniture shopping is not fun for most people. It can be confusing & frustrating.

You don’t always get what you pay for!

Sometimes a mistake can cost you hundreds or thousands of dollars!

Wouldn’t it be wonderful if you had a furniture expert handy to answer all your questions?

Questions about things like:

How does one brand compare with others?

Why did your last couch fall apart after 3 years and how do you make sure the next one lasts longer?

What are the best sectionals that will fit through narrow stairways?

What is the best leather sofa priced below $3000?

Should you buy an extended warranty?

How much will it cost to buy a couch that will last for 20 years?

Why did the leather peel off your last sofa after 3 years? Is it covered under warranty?

What is the difference between foam density and firmness?

Are all those 50% mattress sales really good bargains?

Will extra firm cushions last longer than soft cushions?

Which recliners are best for someone weighing 300 lbs.?

What’s the best fabric for a couch used by a family with lots of kids?

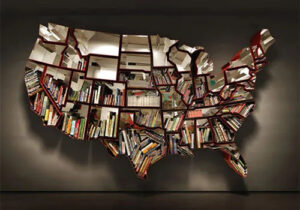

Where can I find handcrafted furniture that’s Made in America?

Should I buy a modular sectional from LovesSac, or Flexsteel, or Hydeline, or Pottery Barn, or Crate & Barrel, or….?

Answers to all those questions (and many more) can be found in the Insiders Guide to Furniture.

Ask the Expert

Do you have a question about furniture?

Get detailed answers here.

Special Discounts

Retailer & Manufacturer Special Discount Pricing for Our Readers

Reviews & Comments

Let us know what you think about the Insider’s Guide to Furniture

Or Go Directly to Reviews & Articles

See What Others Have Asked

66 Best & Worst Sectional and Sofa Reviews April 2024

DreamSofa: Durable Sofas at Affordable Prices. Custom built in the USA